AHV abroad - Taxes

In social security law, emigration means permanently giving up residence in Switzerland; it is not possible to have a dual residence, i.e. one in Switzerland and one abroad. AHV pensions paid to a person resident abroad are not subject to withholding tax in Switzerland, regardless of a double taxation agreement, due to the lack of a legal basis either at federal or cantonal level. Taxation therefore takes place at most in the country of residence.

Payment of AHV pension with residence outside Switzerland

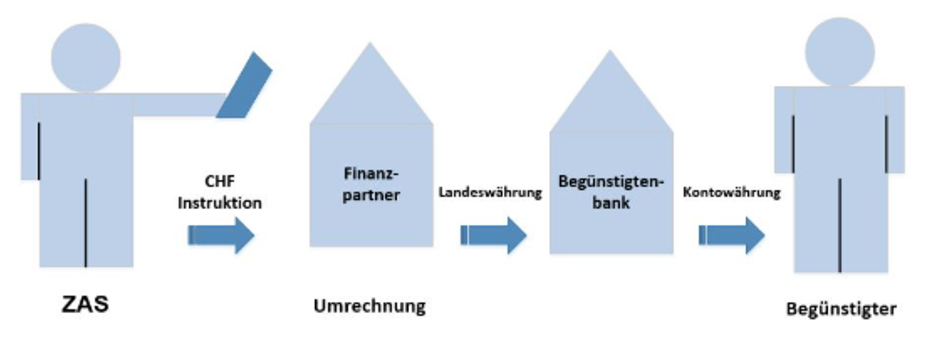

Ordinary AHV pensions can be paid out worldwide regardless of place of residence. The transfer is usually made directly by the compensation office in the national currency of the country of residence. Alternatively, pension payments can be credited to a personal postal or bank account in Switzerland. On the homepage of the Central Equalisation Office (ZAS) the annual payout data for each month is also published.

Processing of payment transactions at ZAS, source: ZAS

Persons not in gainful employment who emigrate to an EU or EFTA member state can no longer take out voluntary insurance in Switzerland. The principle of equal treatment vis-à-vis EU citizens prohibits Switzerland from offering voluntary insurance within the EU to Swiss nationals without also having to open it up to EU citizens. This would have meant financial disadvantages for Switzerland, as the voluntary insurance scheme was already in deficit. Voluntary insurance was therefore abolished for Swiss nationals in the EU and not introduced for EU citizens from the outset. However, an exception was negotiated for countries outside the EU/EFTA: Voluntary insurance is open here to both Swiss and EU/EFTA citizens, provided they were compulsorily insured in Switzerland for at least five years immediately beforehand. Contribution periods in the EU are not taken into account.

These restrictions particularly affect early retirees who emigrate to the EU/EFTA, as they can no longer achieve a full contribution period because they are not allowed to pay contributions until retirement in Switzerland. In some countries it is possible to pay voluntary contributions, but this may result in a pension from the country of residence. The implications of this with regard to health insurance are explained in a separate article.

Registration and AHV pension deferral

The ZAS is responsible for Swiss nationals living abroad. For persons resident in an EU or EFTA member state, different procedures are possible depending on whether or not they have paid contributions in that state. If you have paid contributions there, for example through gainful employment, you must contact the competent social insurance institution in the new country of residence. This liaison office is responsible for issuing the required EU forms and forwarding them to the Swiss Compensation Office in Geneva.

However, if you do not pay contributions in your new country of residence, the social insurance institution of the country in the EU or EFTA in which you last paid contributions, i.e. Switzerland, is responsible. The relevant forms must be completed and sent to the Swiss compensation office in Geneva.

As an expatriate, you can also benefit from flexible pension drawdown, which has been possible since 2023, in order to close the gap of missing contribution years. The deferral must be applied for no later than one year after the regular pension entitlement arises and proof must be provided that it was received on time. If the application is made after this period has expired or the corresponding declaration is missing from the application form, the retirement pension will be determined and paid out without a supplement in accordance with the general rules.

Withdrawal/cancellation of voluntary AHV and deadlines

Voluntary AHV/IV can be cancelled at any time. However, the cancellation only takes effect at the end of the current or next quarter, depending on the time of the declaration. The quarterly ends are 31 March, 30 June, 30 September and 31 December. Contributions are owed until the cancellation takes effect and not retroactively to the previous year. Example: If the declaration of withdrawal is submitted on 10 November, the insurance ends on 31 December of the current year. This means that contributions are still owed for the whole year and the corresponding declaration of income and assets must be submitted. It is important to be aware of these deadlines, as late cancellation may result in contributions being paid that do not increase the benefits.

13 AHV pension with residence outside Switzerland

The 13th monthly payment is part of the regular AHV old-age pension and is paid to all persons entitled to an AHV pension, even if they are resident abroad.

Survivors' pensions abroad

Swiss survivors' pensions (widows', widowers' and orphans' pensions) are also paid to beneficiaries who are resident in an EU or EFTA member state.

The conditions correspond to those in Switzerland. This applies both if your place of residence is already in another EU/EFTA country at the start of your pension and if you move there at a later date.

The payment of a Swiss survivor's pension to an EU or EFTA country has no influence on the amount of the pension.

Swiss IV pensions abroad

Swiss disability pensions (IV pensions) are also paid to beneficiaries who are resident in an EU or EFTA member state.

If you move outside the EU/EFTA, special regulations apply which must be checked individually.

Moving away with consequences:

Moving away from Switzerland can open up opportunities, but also harbours tax and social security pitfalls. Seek advice at an early stage in order to optimise your pension provision and pension payments and start your retirement abroad without any worries.

Have you already considered whether retirement abroad could be a real option for you and what hurdles you consider important in this case? Then we look forward to supporting you in this step. You can also subscribe to our COMPASS and benefit from useful tips for your planning.